-

en

NPL

NPL

Choose Your Country

-

Afghanistan

Afghanistan

-

Angola

Angola

-

Argentina

Argentina

-

Bangladesh

Bangladesh

-

Belorussia-(Belarus)

Belorussia-(Belarus)

-

Benin

Benin

-

Bolivia

Bolivia

-

Brazil

Brazil

-

Burkina-Faso

Burkina-Faso

-

Cambodia

Cambodia

-

Cameroon

Cameroon

-

Chile

Chile

-

Colombia

Colombia

-

Costa-Rica

Costa-Rica

-

Global

Global

-

Dominican-Republic

Dominican-Republic

-

Ecuador

Ecuador

-

Egypt

Egypt

-

El-Salvador

El-Salvador

-

Ethiopia

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS

Ethiopia

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS INTRACITY PRODUCTS

INTRACITY PRODUCTS

-

Ghana

Ghana

-

Greece

Greece

-

Guatemala

Guatemala

-

Guinea

Guinea

-

Haiti

Haiti

-

Honduras

Honduras

-

India

India

-

Iraq

Iraq

-

Kazakhstan

Kazakhstan

-

Kenya

Kenya

-

Kuwait

Kuwait

-

Lebanon

Lebanon

-

Liberia

Liberia

-

Madagascar

Madagascar

-

Malaysia

Malaysia

-

Mali

Mali

-

Mauritius

Mauritius

-

Mexico

Mexico

-

Myanmar

Myanmar

-

Nepal

Nepal

-

Nicaragua

Nicaragua

-

Nigeria

Nigeria

-

Peru

Peru

-

Philippines

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS

Philippines

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS INTRACITY PRODUCTS

INTRACITY PRODUCTS

-

Poland

Poland

-

Qatar

Qatar

-

Republic-of-the-Congo

Republic-of-the-Congo

-

Russia

Russia

-

Rwanda

Rwanda

-

Saudi-Arabia

Saudi-Arabia

-

Sierra-Leone

Sierra-Leone

-

South-Africa

South-Africa

-

Sri-lanka

Sri-lanka

-

Sudan

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS

Sudan

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS INTRACITY PRODUCTS

INTRACITY PRODUCTS

-

Tanzania

Tanzania

-

Thailand

Thailand

-

Togo

Togo

-

Turkey

Turkey

-

UAE

UAE

-

Uganda

Uganda

-

Ukraine

Ukraine

-

Uruguay

Uruguay

-

Yemen

Yemen

Visit The Global Webpage

-

-

-

-

-

-

DOMINAR

Back

Back

Explore the world on your terms with Dominar, a Sports Tourer that’s born to sprint and built to explore anyplace your heart desires.

Official Instagram Page: Bajaj_Dominar_Nepal

-

PULSAR

Back

Back

The ultimate sports bike created for the cityscape with the best in class power, handling & torque for every roads of Nepal.

Visit here for all: Bajaj Bikes Price in Nepal

-

DISCOVER

Back

Back

A stylish-mid ranged bike which stuns you on city streets with the power to ride beyond urban limits.

-

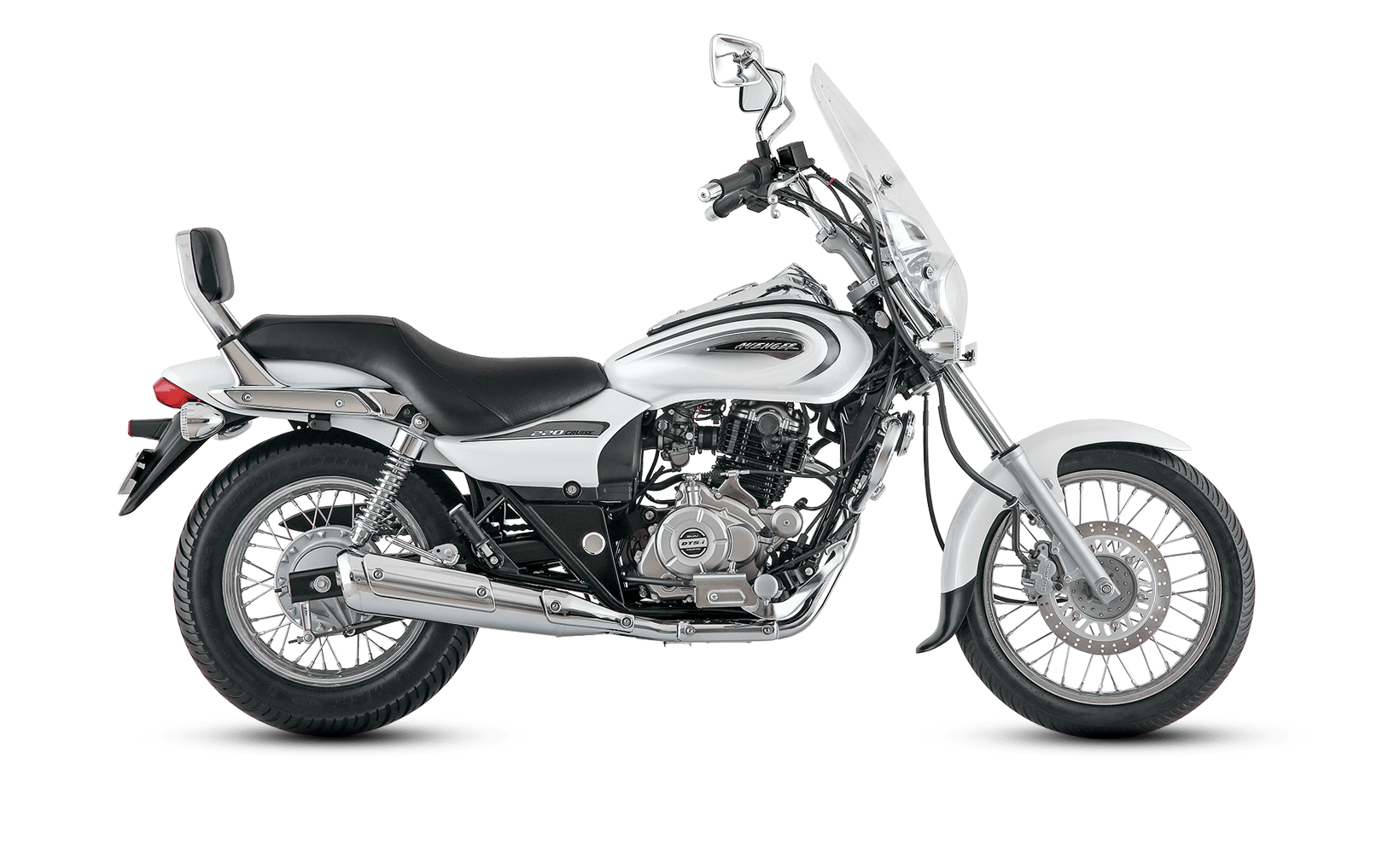

AVENGER

Back

Back

-

PLATINA

Back

Back

A mileage champion to get the best out every last drop of fuel, durably powering longer journeys.

- RE

-

MAXIMA

Back

Back

Bajaj Maxima CARGO

FIND OUT MORE - Bike Price Lists

- Blog

- Test Ride

- Contact Us

-

en

NPL

NPL

Choose Your Country

-

Afghanistan

Afghanistan

-

Angola

Angola

-

Argentina

Argentina

- $name

-

Bangladesh

Bangladesh

-

Belorussia-(Belarus)

Belorussia-(Belarus)

-

Benin

Benin

-

Bolivia

Bolivia

-

Brazil

Brazil

-

Burkina-Faso

Burkina-Faso

- $name

-

Cambodia

Cambodia

-

Cameroon

Cameroon

-

Chile

Chile

-

Colombia

Colombia

- $name

-

Costa-Rica

Costa-Rica

-

Global

Global

- $name

-

Dominican-Republic

Dominican-Republic

-

Ecuador

Ecuador

-

Egypt

Egypt

-

El-Salvador

El-Salvador

-

Ethiopia

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS

Ethiopia

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS INTRACITY PRODUCTS

INTRACITY PRODUCTS

-

Ghana

Ghana

-

Greece

Greece

-

Guatemala

Guatemala

-

Guinea

Guinea

-

Haiti

Haiti

-

Honduras

Honduras

-

India

India

- $name

-

Iraq

Iraq

-

Kazakhstan

Kazakhstan

-

Kenya

Kenya

-

Kuwait

Kuwait

-

Lebanon

Lebanon

-

Liberia

Liberia

-

Madagascar

Madagascar

-

Malaysia

Malaysia

-

Mali

Mali

-

Mauritius

Mauritius

-

Mexico

Mexico

- $name

- $name

-

Myanmar

Myanmar

-

Nepal

Nepal

-

Nicaragua

Nicaragua

-

Nigeria

Nigeria

-

Peru

Peru

-

Philippines

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS

Philippines

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS INTRACITY PRODUCTS

INTRACITY PRODUCTS

-

Poland

Poland

- $name

-

Qatar

Qatar

-

Republic-of-the-Congo

Republic-of-the-Congo

-

Russia

Russia

-

Rwanda

Rwanda

-

Saudi-Arabia

Saudi-Arabia

-

Sierra-Leone

Sierra-Leone

- $name

-

South-Africa

South-Africa

- $name

-

Sri-lanka

Sri-lanka

-

Sudan

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS

Sudan

XWHAT ARE YOU LOOKING FOR?MOTORCYCLE PRODUCTS INTRACITY PRODUCTS

INTRACITY PRODUCTS

-

Tanzania

Tanzania

-

Thailand

Thailand

-

Togo

Togo

-

Turkey

Turkey

-

UAE

UAE

-

Uganda

Uganda

-

Ukraine

Ukraine

-

Uruguay

Uruguay

-

Yemen

Yemen

- $name

Visit The Global Webpage

-

-

DOMINAR

Advantages of Motorbike Insurance in Nepal

Insurance is the best way to decrease risk while riding your motorbike from theft to road accidents. As the road is not always a safe place, it is better to follow preventive measures and not worry about the financial crisis if you do come across an accident.

Compulsory by law

Third-party insurance is mandatory by law in Nepal. Anyone who doesn't have their insurance papers, license, and the blue book is always liable for being taken action by the law. A precautionary measure would be to do third party insurance. Even to renew your blue book in Nepal you need to provide valid Insurance.

Peace of mind

Insurance has two purposes. Prevention of possible danger and stress. Because you are being responsible and doing the right thing, you can be certain of financial safety and mental peace if you are covered. When you have valid insurance and renew it on time, you protect your two-wheeler and yourself from unforeseen occurrences.

Types of Motorbike Insurance Policy:

✔ Comprehensive insurance (Full Insurance)

✔ Third party Insurance

Third Party Insurance

Third Party Insurance policy protects you against damages including a third-party person or their property while riding your covered Motorbike.

It might not be easy to cover for the third party as the amounts are never fixed. If you have insurance, your insurance provider will pay the compensation. Any legal cases that may arise as a result of an unpleasant event will also be covered by your insurance.

Comprehensive Coverage (Full Insurance)

A Third-Party Insurance Policy only covers third-party damages and resolves any legal concerns that may arise. However, a Comprehensive Two-Wheeler Insurance Policy cover damages to both you and the third party. It provides extensive coverage of both natural and man-made disasters.

In addition to the normal policy, premium features of made available by many insurance companies, where you can add a pillion rider (back seat), zero deprecation, and Two-Wheeler Insurance Personal Accident Coverage are some of them.

Medical Coverage

In case of an accident resulting in major health issues or disabilities, the insurance covers a large number of finances depending on the insurance subscription. Medical bills can’t be pre-determined, thus it is wiser to think about your wellbeing.

Discounts

A two-wheeler insurance policy is not as costly as it seems. You don't have to pay the whole amount of the premium each time you renew your insurance. You will get discounts on your coverage if you drive safely and do not file a claim on your policy. The No Claim Bonus will begin with the initial renewal of two-wheeler insurance.

Insurance Process:

✔ Fill form from your choice of insurance

✔ KYC form should be filled out as well

✔ Motorcycles proof of purchase

✔ Blue Book Original/Photocopy

Also View: Things To Check Before Buying Motorbike